Get more out of Afterpay.

Make Afterpay work for you. Find out how to level-up your Afterpay experience.

New features for financial flex.

Watch our video to learn how our latest features will have you being the boss of your payments.

Start with the basics.

Pay it in 4. In-store.

Enjoy all the perks of Afterpay in-person. Add the digital Afterpay Card to your phone’s wallet via the app, shop in-store then pay over 6 weeks.

Set up now

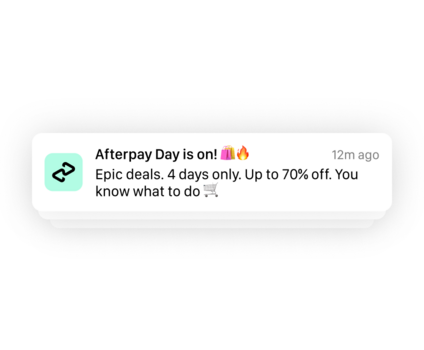

Catch a deal with the app.

Use the Afterpay app to find the best deals and exclusive offers from top brands. Turn on your notifications so you don’t miss a thing.

Save it. Label it. Plan it.

Tap the heart to save, list and organise all your favourite products. Plan a budget before you check out by tapping $ and get a breakdown of the payments due.

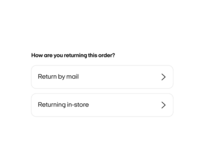

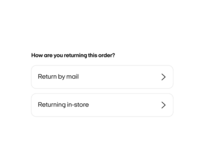

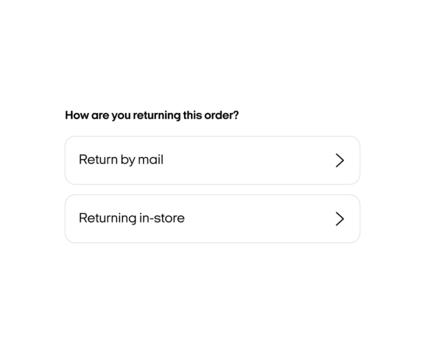

Don’t sweat the returns.

Start your return directly with the store, then once the store notifies us, we’ll refund you, starting with your final payment and working backwards. Log your return in the app to pause any future payments.

Find out more

Manage your money with confidence.

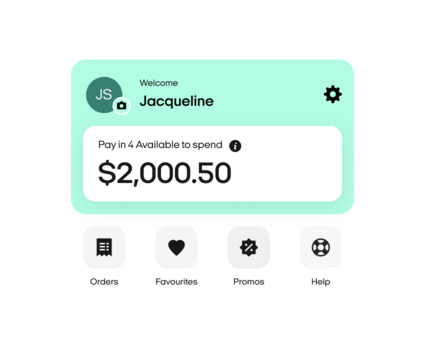

Keep tabs on your orders & payments.

Check your spend limit and orders in the My Afterpay tab. Stay on top of payments by turning on notifications so we can send you reminders.

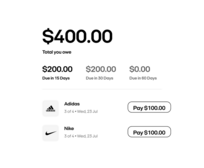

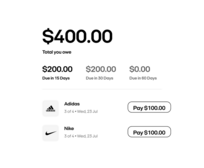

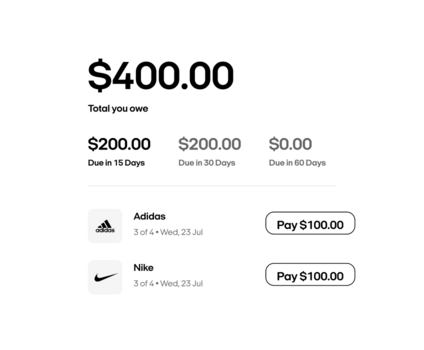

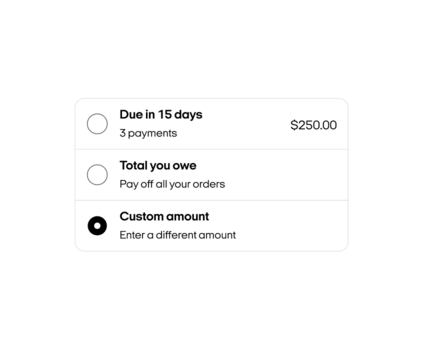

Make multiple payments with one tap.

You can choose to pay early, pay multiple orders at once, or pay the entire remaining balance.

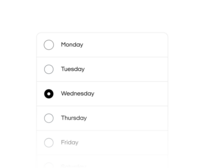

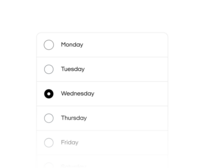

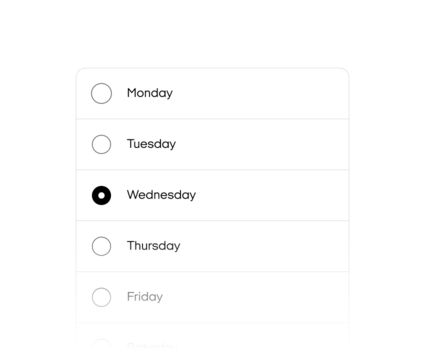

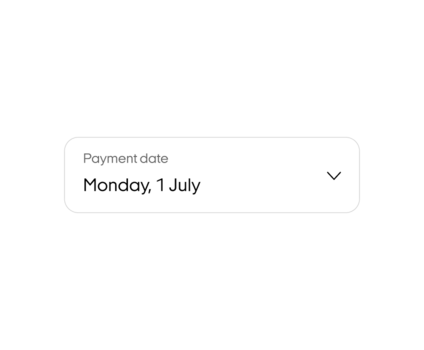

Fit payments to your schedule.

Schedule your payments to a day of the week that suits you. Pick your day in Payment settings in the app. Applies to future orders only.

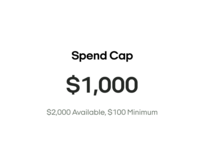

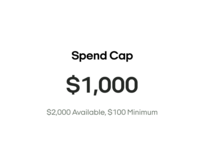

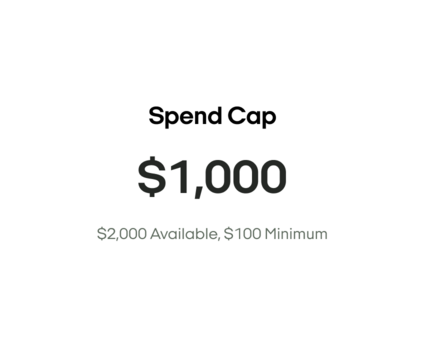

Set a spend cap with a few simple taps in the My Afterpay tab.

It's another way to manage your spending, while maintaining your approved limit for a rainy day.

Wiggle room when you need it.

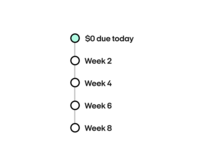

Reschedule your next payment by a week if you need; you can do this up to three times a year. It’s important to note that some payments can’t be changed though.

Find out more

Need help to keep up?

We’re here to help. If you’re experiencing financial hardship, you should contact us as soon as possible to discuss your options.

Find out more

More perks.

Been with us for a while and have a good track record of consistent on-time payments?

Then these benefits are for you.

Been with us for a while and have a good track record of consistent on-time payments? Then these benefits are for you.

Get more time to pay.

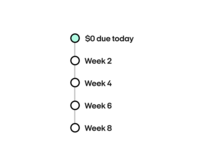

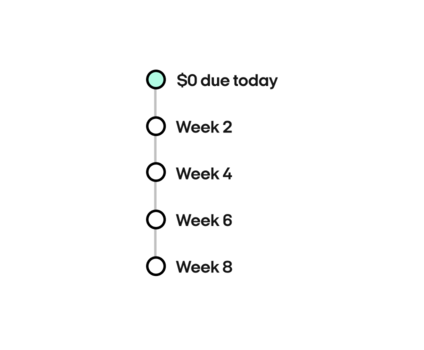

Delay your first payment by up to two weeks with our ‘no payment upfront’ feature. That’s right, pay $0 upfront on eligible purchases under $500, excluding gift cards, and purchases at fuel or grocery merchants. Access is dependent on a range of factors - we’ll notify you if you’re eligible.

The gift of choice. The luxury of time.

Eligible customers can pay it in 4 across a wide range of gift cards delivered straight to their inbox.#

Find out more

Increase your spend limit.

We do this gradually, once we get to know you. We factor in your on-time payments and history with Afterpay.

Depending on a variety of factors, Australian customers may be prompted for more information in the app, in order to qualify for a spend limit increase review.

Afterpay almost anywhere.

Eligible customers can upgrade to Afterpay Plus for $9.99 a month to use Afterpay almost anywhere.

Fees, T&Cs, eligibility and credit criteria apply. Subject to product and merchant exclusions. Australian Credit Licence 527911.

Find out more

Are you an Afterpay fan? Share the love.^

Late fees, eligibility criteria, retailer terms and T&Cs apply. Australian Credit Licence 527911

# Late fees, T&Cs, eligibility and credit criteria apply. Subject to product and merchant exclusions. Australian Credit Licence 527911. See Prezzee and afterpay.com for full terms.

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

Can I reschedule a payment on an existing order?

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I no longer have access to the ‘no payment upfront’ feature - why?

If you previously had access to the ‘no payment upfront’ feature and have missed some payments on your account, or haven’t used Afterpay in a while, this will result in the feature being deactivated. We may also deactivate the feature in accordance with the Afterpay Terms of Service.

The good news? We review access regularly. Keep using Afterpay, stay on top of your payments and we might have good news for you soon. Be sure to have your app updated and your notifications enabled.

What is ‘no payment upfront’ and how does it work?

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

- Purchases from grocery or fuel merchants. This includes supermarkets and similar businesses, petrol stations, and some convenience stores.

I’ve already used up my 3 self-service reschedules for the year, but need to move more. What can I do?

If for some reason you can no longer make a payment, please get in touch via the app to see if we can help.

I no longer have access to the ‘no payment upfront’ feature - why?

Why is my purchase of gift cards declining?

As with all Afterpay purchases, we make a decision to approve or decline the purchase immediately. This decision is completely managed by Afterpay, not Prezzee.

There are a few different reasons as to why your purchase could be declining; it could be that you have more than one gift card outstanding with us, or if you’re a new customer, there are maximum amounts you can purchase with us. It is also important to note that we do not approve 100% of purchase attempts; many factors are at play including fraud prevention.

It may help to wait a while, or pay off the balance of any outstanding orders before attempting to try again.

Why is my purchase of gift cards declining?

What is a credit check?

Credit checks are when lenders make an enquiry to a credit reporting bureau to obtain a customer’s credit report. It is a summary of your credit history and helps businesses to assess risk and make informed decisions about things like lending or offering services.

At Afterpay, we conduct credit checks to assess new customer applications. We may also perform a credit check when assessing your eligibility for a spend limit increase. These checks are part of our obligations under Australian Buy Now, Pay Later regulations.

Why is my purchase of gift cards declining?

What is a credit report?

A credit report is a summary of your credit score and credit history, which may include loans, credit accounts, and how you've managed them. Lenders may use this report to gauge how you manage credit. Credit reporting bureaus build your report from data shared by lenders, financial institutions, and publicly available information from government departments and agencies.

Your credit report is about you, but it's owned by the credit reporting bureau. Understanding your credit report can help you make better financial decisions. You have the right to access it for free and correct any mistakes. Please reach out to illion Australia by following the "Contact Us" directions on their website.

For more information we encourage you to visit the Australian’s government’s MoneySmart website.

Why is my purchase of gift cards declining?

What is a credit score?

A credit score is a numerical expression created by a credit reporting bureau.

Your credit score is calculated based on what's in your credit report. For example:

- The amount of money you’ve borrowed

- The number of credit applications you’ve made

- Whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

The information above has been provided by the Australian government’s MoneySmart website.

Why is my purchase of gift cards declining?

Why can’t I access Afterpay Plus?

There are a few reasons why you might not see the option to subscribe to Afterpay Plus. This could be due to:

Afterpay Plus is currently only available to existing customers on an invitation-only basis.

Your eligibility status may have changed due to a change in your account status.

You can check your availability for Afterpay Plus via the Afterpay app. For more information visit our Afterpay Plus page.

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

What is ‘no payment upfront’ and how does it work?

Received a notification at the checkout that there’s $0 due on the purchase date? Congratulations! This means that you have access to our ‘no payment upfront’ feature.

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

- Purchases from grocery or fuel merchants. This includes supermarkets and similar businesses, petrol stations, and some convenience stores.

I’ve already used up my 3 self-service reschedules for the year, but need to move more, what can I do?

Can I reschedule a payment on an existing order?

Yes, you can reschedule your next payment by a week. You can do this up to three times a year. Simply select the payment that you wish to change, tap More in the top right of your screen, and then select “Change next payment date”.

Some payments cannot be changed. If the option is not available, you will see a message on screen that says "Uh oh! This payment date can’t be changed"

Reasons why:

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I no longer have access to the ‘No payment upfront’ feature - why?

Can I buy gift cards from Afterpay?

Why is my purchase of Gift Cards declining?

How can I increase my spend limit?

The best way to become eligible for a spend limit increase is by demonstrating consistent on-time payment behaviour.

We review account behaviours like this regularly, along with other factors, to assess whether increased spend limits are appropriate.

If we need any additional information from you to complete a review, we’ll get in touch via the app.

We may also perform a credit check when assessing your eligibility for a spend limit increase. These checks are part of our obligations under Australian Buy Now, Pay Later regulations.

Contacting Afterpay will not lead to a spend limit increase.

How can I increase my spend limit?

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

What if I don’t want credit checks, will I still be able to use Afterpay?

Credit checks help us fulfil our regulatory obligations in Australia. Our Privacy Policy outlines how we work with credit reporting bureaus to perform these checks.

For new customers:

When you sign up, a credit check helps us assess your application to join Afterpay. We can’t approve new accounts without completing a credit check.

For existing customers:

We may perform a credit check when assessing whether a higher spend limit is appropriate. Without completing a credit check, we may not be able to assess you for a spend limit increase.

How can I increase my spend limit?

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

What information is being reported to credit bureaus?

As part of Australian Buy Now, Pay Later regulations, we’re required to perform credit checks when you sign up and we may perform a credit check when assessing your eligibility for a spend limit increase.

When we do this, we share your personal details with credit reporting bureaus — things like your name, date of birth, and address — so they can locate your credit file. These credit enquiries may be visible to other credit providers on your report.

Right now, we do not report your repayment history, account limits, or other ongoing account activity to credit reporting bureaus.

In the future, if we plan to begin reporting this information — we’ll let you know before anything changes.

How can I increase my spend limit?

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

If I have a bad credit score, will I still be able to use Afterpay?

When you apply to join Afterpay, we consider a variety of factors — including information from your credit report — to assess whether an account is right for you.

Having a low credit score, or no credit history at all, won’t automatically prevent you from being approved. Similarly, having a great credit score doesn’t guarantee approval either. We assess each application carefully, based on a combination of factors.

If you already have an account and become eligible for a higher spend limit, we may perform a credit check as part of that assessment. We’ll always ask for your consent before we do. A lower credit score won’t necessarily mean a lower spend limit, just as a higher score doesn’t guarantee an increase.

If a spend limit increase isn’t right for you at the time we assess your eligibility, your existing spend limit won’t change. However, please note that missing payments or changes in your account activity may result in a lower spend limit.

Want to know more?

Check out our How Afterpay Works page, or head to our Help centre.